Most ministers do not understand, that while their ministries are exempt from paying taxes, their ministries are NOT exempt from filing taxes. The IRS uses Form 990 to ensure that tax-exempt organizations are continually complying with nonprofit requirements in order to remain tax-exempt. Unfortunately, most ministries miss this requirement and fail to be renewed. This is a costly mistake because the IRS charges a late fee of $20 per day.

Every ministry is different and requires different forms to be filed. Because there are so many variables that determine which Form 990 you need to file, we encourage you to give us a call in order to ensure that your ministry files the correct form. Our consultants ask you a series of questions that help determine which Form 990 your ministry should file.

In general, Form 990s are due May 15th of each year. However, depending on your ministry's fiscal year, your Form 990 due date could be different.

Call us today and let us help you get back on track!

Ministries do not know they need to file

Oftentimes ministries are unsure if they even have to file a Form 990. While it is true that churches do not, all other 501(c)(3) organizations and other tax-exempt entities, are required to file whether or not they are religious.

Ministries do not know what form to file

Once ministries discover that they need to file Form 990, most are unsure of which form to file. There are three Form 990s to consider: Form 990-N, Form 990-EZ, and, Form 990. The amount of income and assets your ministry has determines which Form 990 to file.

Ministries forget that this is an annual requirement

When you are running a nonprofit ministry, the last thing on your mind is filing your Form 990. We understand that it can be easy to forget, which is why we have set up this service, so you do not ever have to remember it again.

Once your ministry obtains its Federal Employer Identification Number (FEIN), you will need to begin filing the appropriate Form 990 the following tax year. Take note that failure to file your ministry's Form 990 for 3 consecutive years will result in an automatic revocation of tax-exempt status - even if you have not applied for your ministry's 501(c)(3) status.

**The only charitable organization NOT required to file Form 990 is a church.**

WHICH FORM TYPE IS RIGHT FOR YOU?

There are 3 different tiers of the 990 form: 990-N, 990-EZ and 990 Long. The type of form needed is determined by the income of the organization on a yearly basis.

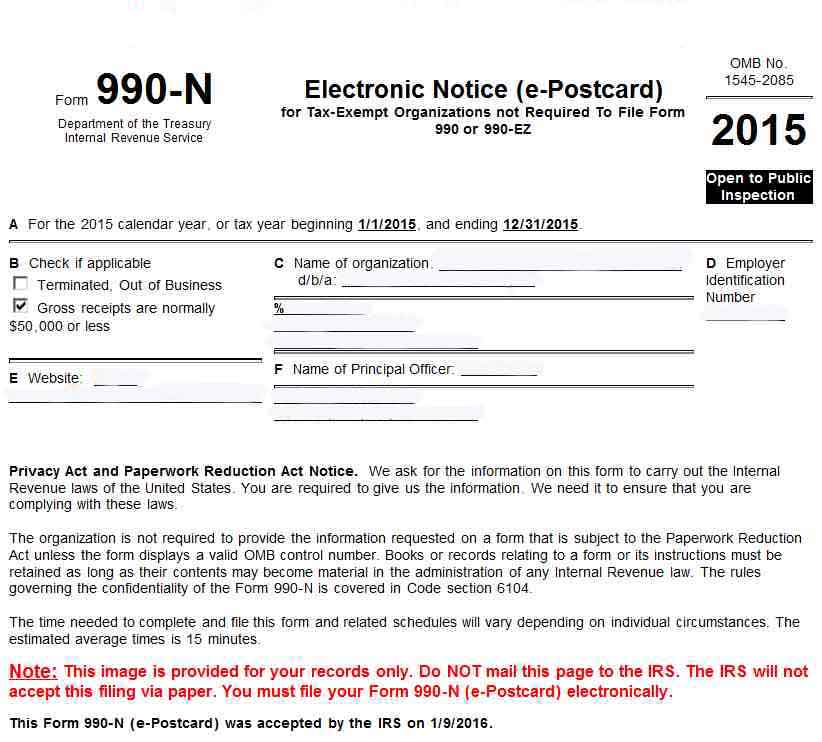

Form 990-N: Gross income of $50,000 or less

A Form 990-N is an electronic notice. Organizations with gross receipts of normally $50,000 or less will file this electronic notice.

Get started

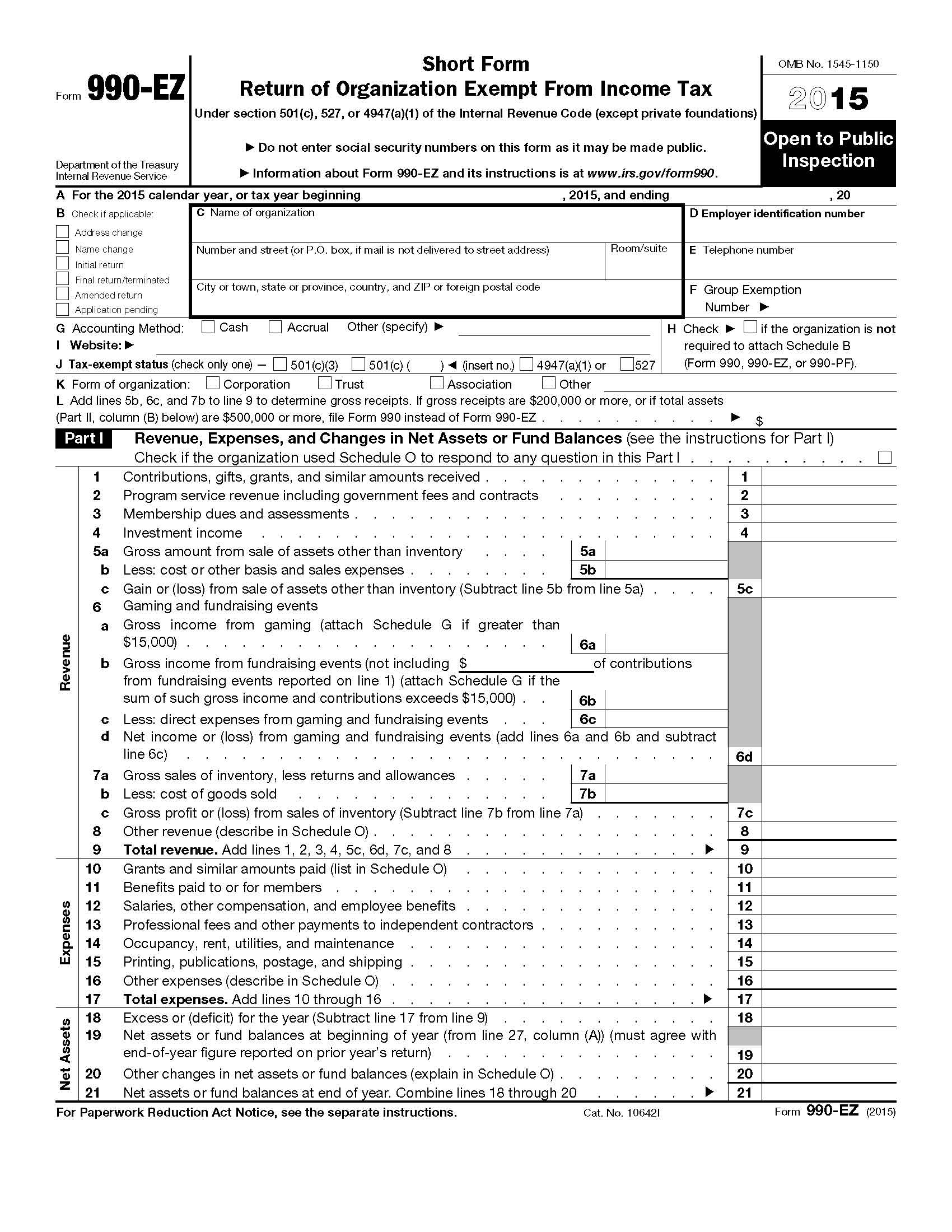

Form 990-EZ: Gross income of $200,000 or less and assets less than $500,000

Organizations with gross receipts of normally more than $50,000 but less than $200,000, and whose assets are valued at less than $500,000, are required to file this form.

Get started

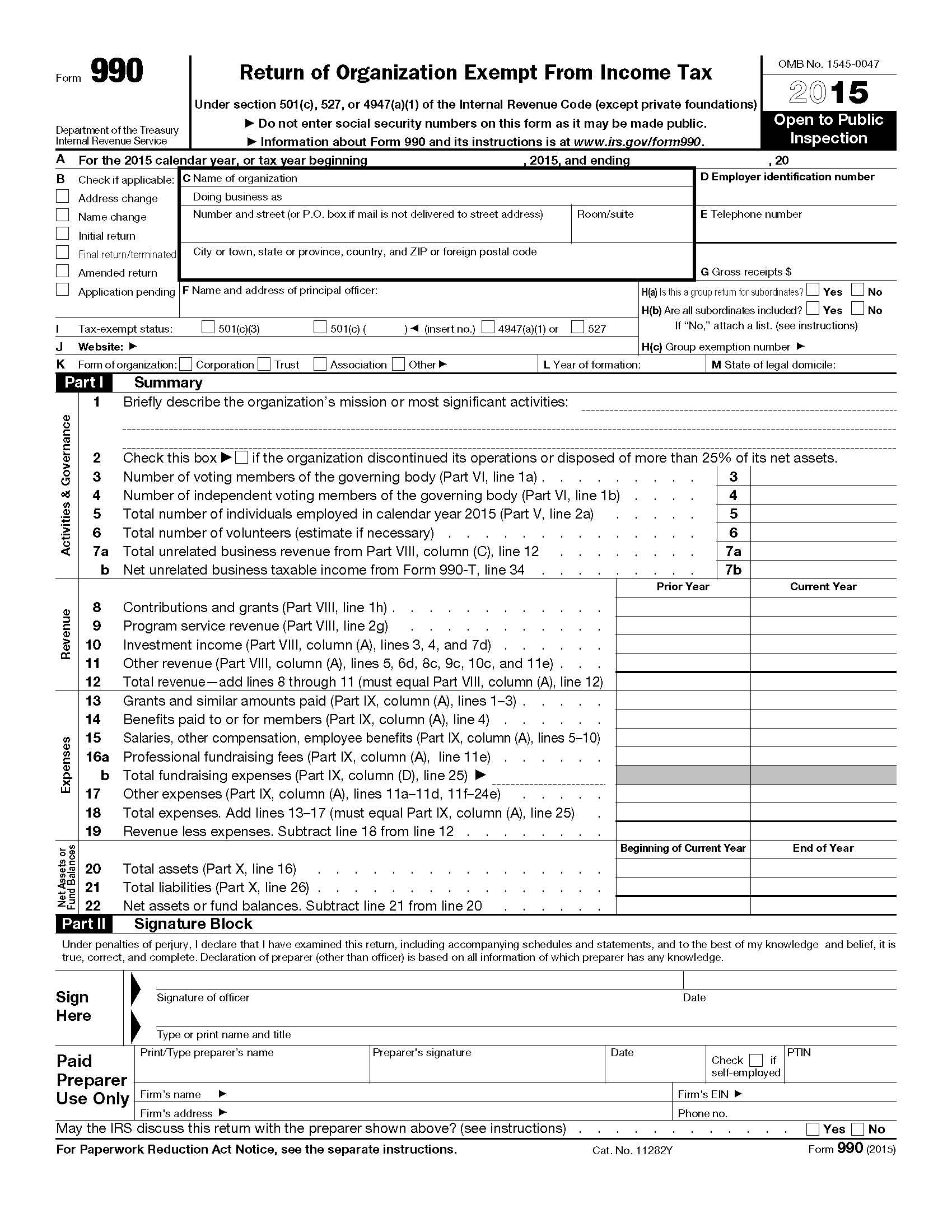

Form 990-Long: Gross income greater than $200,000 and assets greater than $500,000

Organizations whose gross receipts are on average $200,000 or greater, and whose assets are valued at $500,000 or greater, are required to file Form 990.

Get startedDo you want to know more? We'd love to hear from you!

Are you ready to get started?

Do you have any questions or concerns?

Whatever they may be, we are here for you. Call us today and one of our specialists will gladly assist you with your needs.