New 2025 Accounting Rules

By Raul Rivera

New cryptocurrency accounting rules give churches a chance to turn compliance into a banking advantage, opening doors to greater funding opportunities. The Financial Accounting Standards Board (FASB) recently introduced a rule mandating that cryptocurrencies be accounted for using fair value accounting. So, what does this mean? Fair value accounting requires organizations to report the market value of their cryptocurrency holdings rather than just their initial donation value. This approach provides a real-time snapshot of what these assets are worth, factoring in the natural price fluctuations that come with digital currencies like Bitcoin.

For churches embracing cryptocurrency investments and donations, understanding fair value accounting is more than compliance; it’s a step toward better financial stewardship. This method allows churches to capture the true value of their digital assets, enabling leaders to make informed decisions that support their mission.

Understanding Fair Value Accounting for Cryptocurrencies

Historically, churches and nonprofits have accounted for cryptocurrency donations using traditional cost accounting methods. However, with the rise of digital assets like Bitcoin, the Financial Accounting Standards Board (FASB) now requires fair value accounting for cryptocurrencies. So, what exactly does fair value accounting mean for cryptocurrency?

Fair value accounting for digital assets like Bitcoin requires organizations to report these assets based on their current market value, not their purchase price or original donation value. This approach is especially significant for digital assets like Bitcoin, where values can fluctuate. By recording the fair market value, churches can better understand and leverage the actual value of their holdings, providing a clear picture of their financial position at any given time.

Why Fair Value Accounting Matters for Your Church

Think of it this way: when you record cryptocurrency assets at their fair value, you’re providing a real-time view of your church’s financial health. It’s a shift that helps you see the current, realistic potential of your resources, empowering you to make more informed decisions. Fair value accounting ensures that your church leaders, donors, and stakeholders have a clear understanding of the actual worth of the church’s cryptocurrency assets.

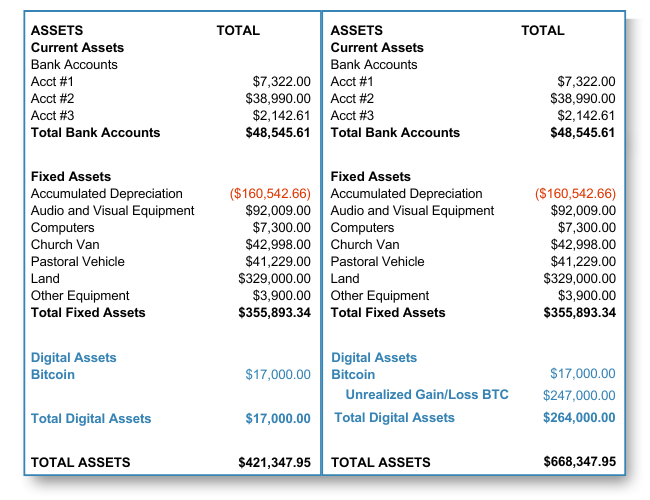

Let’s look at how fair value accounting can transform Church ABC’s balance sheet. Church ABC bought 2 Bitcoin when it was priced at $4,000 each, and they also received 1 Bitcoin as a donation when it was valued at $9,000. Under traditional accounting, the balance sheet would show these holdings at their initial values, totaling $17,000 in Bitcoin. Please see a side-by-side comparison in the footnotes below.

However, with fair value accounting, as of November 11, 2024, Bitcoin’s market value stands at $88,000 each. This updated approach would reflect Church ABC’s holdings at $264,000 on the balance sheet.

This increase in value doesn’t just look good on paper—it opens up practical possibilities. With banks expected to offer Bitcoin custody services soon, churches may be able to use Bitcoin as collateral for loans. Imagine the opportunities this could create for financing church projects and growth.

The wisdom of Proverbs 27:23 rings true: “Be sure you know the condition of your flocks, give careful attention to your herds.” Keeping an accurate view of your church’s assets is a vital part of stewardship.

How StartCHURCH is Leading Churches into the Future

At StartCHURCH, we’re more than just bookkeepers; we’re partners in your mission. We understand that managing cryptocurrency donations and assets is new territory for many churches. That’s why we’ve invested in training our bookkeepers and CPAs to handle cryptocurrency with expertise and foresight. We don’t just record past transactions; we help you see the road ahead, equipping your church to use these new resources wisely.

Why Your Church Should Act Now

In an unpredictable economic environment, having an accurate view of all your assets is essential. Adopting fair value accounting for cryptocurrencies is one way your church can prepare for whatever the future holds. At StartCHURCH, we’re here to guide you every step of the way, offering bookkeeping services that go beyond traditional accounting. We believe that by embracing fair value accounting, churches can strengthen their financial foundation, ensuring they’re ready to seize new opportunities.

The world of digital assets is growing, and churches that understand and adapt to these changes will be better positioned to thrive. When it comes to stewardship, let’s not be reactive but proactive, looking ahead and making wise choices. As the Bible says in Luke 16:10, “Whoever can be trusted with very little can also be trusted with much.” Handling new assets responsibly today builds a foundation of trust for tomorrow.

%bookkeeping-cta%

Let’s Embrace the Future Together

At StartCHURCH, our goal is simple: to help you manage your church’s resources with excellence and vision. As fair value accounting becomes standard, we’re committed to ensuring your church not only meets these requirements but also understands how to use them to support its mission. By partnering with us, you’re choosing a team that’s ready to lead your church into the future, equipped with the best practices, tools, and guidance for a thriving ministry in the digital age.

%schedule-a-call-cta%